Reliance and Aditya Birla continue their purchasing spree, ushering in a new age for designer clothes and fashion

Manish Malhotra, House of Masaba, Tarun Tahiliani, Sabyasachi, and Anamika Khanna. These are just a few of the many designer brands that Aditya Birla and Reliance, two of India’s most prominent business groups, have invested in.

The retail and fashion arms of the business groups, Aditya Birla Fashion and Retail Ltd (ABFRL) and Reliance Retail Ltd (RRL), have been on a shopping spree for the past 24 months or so. Even though both top players (Aditya Birla and Reliance) are more interested in luxury brands, they have either bought all of or the majority of both luxury and premium brands in the country.

Even though the pandemic stopped some events, like weddings, for a while, the growth of clothing and fashion in the country has been steady. Clothing and style are things that Indians buy the most. Euromonitor International’s market research company said that the size of the clothing and fashion market in India in December 2021 was INR335,117 crore. Between 2021 and 2026, the industry is expected to grow at a CAGR of 15%. ABFRL and RRL are both trying to get a piece of this.

But how do these deals help both the buyer and the brand being bought? Both Aditya Birla Fashion and Retail Ltd and Reliance Retail Ltd are well-known conglomerates in the ready-to-wear clothing market. How will these acquisitions help the conglomerates?

Getting acquisitions to work well with each other

There were a lot more acquisitions in the last two years of the pandemic.

Mahesh Singhi, the founder and managing director of the deal-advising firm Singhi Advisors, says that Reliance Brands and Aditya Birla Fashion have been making acquisitions or forming partnerships for the past four to five years to strengthen their positions in the retail industry. This is good for both sides.

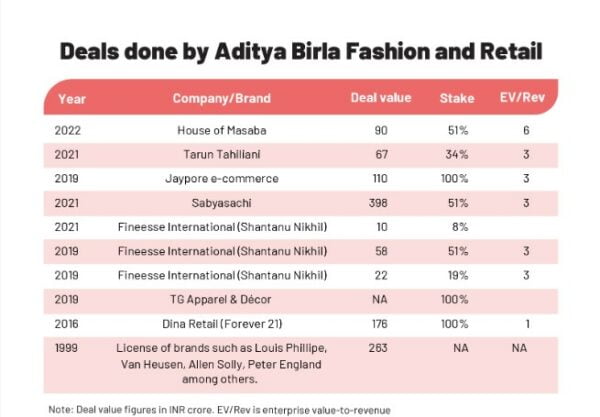

“Reliance Brands and Aditya Birla Fashion have teamed up with many companies. This gives the retail giants a chance to expand their product lines, and it gives the designer brands a chance to grow by opening more stores, making new product lines, etc., which lets them reach a wider range of shoppers. “Most of the recent acquisitions have been done at a multiple of the brand’s revenue of around three times, with a few done at high multiples of seven to eight times,” he says.

For example, according to the most recently filed financial notes, Aditya Birla Fashion and Retail Ltd’s investment in House of Masaba could help the brand’s new line of beauty and personal-care products.

The conglomerates that bought these designer brands haven’t said much about how they will be run, but sources in the industry say that the creative directors, or the designers behind the brand, will probably still be in charge of the leading couture brand.

The truth is that these new investments will probably help both conglomerates and designer brands. Why?

The conglomerates sell many goods, and they know how to make a lot of sales. They also have more money, which gives them the financial stability they need while building a brand.

In the same way, designer brands may not be the biggest sellers, but they know more about couture and high-end fashion and, most importantly, have a well-known brand.

The main reason for these mergers and purchases is simple: it will make things better for both the buyers and the brands being bought.

These acquisitions help the two conglomerates get a well-known brand and, by extension, the people who like that brand without starting from scratch.

Besides that, three questions and observations come to mind:

1. Will this lead to a duopoly in the clothing business at every price point?

Both companies’ primary strategy is to offer a wide range of prices so that all customers can find something they can afford. For men, Aditya Birla Fashion and Retail Ltd has always carried brands like Van Heusen, Allen Solly, and many more. With the help of its purchases, Aditya Birla Fashion and Retail Ltd will have brands for women ranging from Jaypore to Sabyasachi Couture.

Does this mean that Indian design companies, whether luxury or not, will be able to make more money?

Most designer brands have one face and name, usually that of the brand’s creative director. All designer brands, like Sabyasachi, Tarun Tahiliani, and House of Masaba, are driven by one person’s vision. Even though these companies have been around for decades and have big brand names, most haven’t even made INR100 crore in sales. This kind of business investment could finally help designer brands in the country make more money.

Will this make Indian designers more well-known in the West?

Most of India’s high-end brands are well-known in other countries where Indian people live. But the way Indian designer brands are sold is nothing like that of international premium or luxury brands, and Gucci or Prada comes to mind. With the help of these big companies, designer brands will be able to sell and distribute their products in more places around the world.

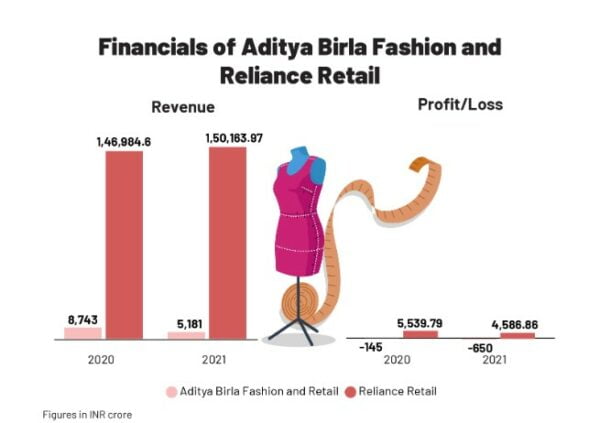

Through mergers and acquisitions so far, Aditya Birla Fashion, which has lifestyle brands like Allen Solly, Peter England, Van Heusen, etc., had INR5,181 crore in sales for the year that ends on March 31, 2021. The fact that its luxury segment of super-premium brands grew by 37% from one year to the next is essential, as is the fact that its ethnic-wear element has a run rate of INR400 crore per year.

Industry sources say that the organized or branded, ready-to-wear clothing market makes up more than half of the total market. Women’s ethnic wear is the main reason for this.

Adity Chaudhury, a partner at Argus Partners, says that the high-end part of the Indian market has been increasing. “It makes sense for designers and big companies to work together to take advantage of this growing market. He says, “Corporate houses are racing to build a strong portfolio of brands.”

“Corporatization will also help keep the brands going in the long run, which is an important point. “These investments also give the designers a chance to unlock some value,” says Chaudhary.

What’s the big deal about designer brands all of a sudden?

Euromonitor says that the designer clothing market in India is worth INR2,043 crore and is expected to grow at a CAGR of 12% from 2021 to 2026.

But, unlike in the West, most of the high-end fashion in our country is focused on ethnic or wedding wear.

Even though the pandemic was terrible, it wasn’t bad enough for Indians to put off their weddings. Instead, more intimate weddings became more popular due to social norms that pushed people apart. So, a couple willing to spend more than INR50 lakh on a wedding still had enough money. So now, wealthy couples are more than happy to spend that extra dollar on designer clothes instead of an extensive guest list.

Harmeet Bajaj, well-known fashion education and communication consultant, asks, “Who will you wear to your wedding? This is a big question right now, both in India and among the Indian people who live in other places. The New Age couples want to make sure that some of their clothes have designer names on them. Even though not everyone in the wedding party of the bride and groom will spend the same amount on luxury couture, almost everyone in the family will wear some designer wear.

Could this be why Aditya Birla Fashion and Retail Ltd and Reliance Retail Ltd buy brands with different price points? It seems that way.

With the help of these acquisitions, conglomerates like Aditya Birla Fashion and Retail Ltd and Reliance Retail Ltd can now give Indian consumers more choices as they start to have more money to spend on things they want.

Brands and the growth of categories

Chaudhary from Argus Partners says that these purchases look like intelligent moves. “In terms of how acquisitions are set up, we see similarities. Both groups have been buying up a lot of shares in fashion houses, and in many cases, they control the companies. So, in the control deals, the designers would still be in charge of the ideas, but the corporate houses would be in charge of the business,” he says.

In addition to giving conglomerates more options, putting corporate money into the designer clothing industry will also provide designers with more options.

For example, Sabyasachi Couture is known for its bridal lehengas, but the brand also has jewelry from the past that was released in 2017.

Since Aditya Birla Fashion and Retail Ltd invested in the company, the designer brand put out a line with H&M, the market leader in fast fashion, in August 2021. The line sold out in just a few hours. The designer also worked with Starbucks in 2022 to make a line of drinkware for that company.

In the same way, Anamika Khanna’s leading design brand is still Indian ethnic wear, which is mainly worn at high-end weddings. Its other brand, AK-OK, which Reliance owns 60 percent of, focuses on high-end western wear that can be worn daily and mostly sold through e-commerce.

Even though RRL doesn’t know much about designer brands, it does know what kind of marketing push and retail reach an e-commerce brand needs.

In the same way, House of Masaba and e-commerce giant Nykaa launched their beauty line in 2019. But since Aditya Birla Fashion and Retail Ltd put money into House of Masaba, the company plans to add more beauty products in 2022.

People who work in the industry think that with the money from corporations, creative designers can focus on making more lines of products and designs at different price points instead of just fashion.

The expansion might not always make things more affordable, but it will give designers a chance to try out new products and categories that might be more wearable.

For example, a bride will probably only wear a Sabyasachi bridal lehenga once. Indian designer wear brands, which mostly only make dresses for weddings, have very low wearability, and this is because most of their fans want to look like them.

With the jewelry and other collections (read: H&M), the designer can reach a newer part of the market, like people who might be looking for cheaper options. Also, the designer’s clothes will be much more likely to be worn.

“It is possible to grow retail and run designer brands. I’ve worked with several designers who know how to market and position their brands in retail stores in India and around the world very well. What works for international designer brands, on the other hand, is that the clothes can be worn. “Consumers can wear a classic black dress by one of the top luxury brands, like Valentino or Armani, repeatedly for different events,” says Bajaj.

When it comes to Indian designer clothes, this is usually only the case with sarees and maybe to some extent with men’s suits. Lehengas are rarely worn more than once, so spending so much money on one is not good.

In conclusion

The latest fashion mergers and acquisitions could help both corporate houses bring their strategic acquisition play into the world of high fashion by building omnichannel networks and taking a direct-to-consumer approach.

In addition to giving the fashion houses more money, this could also make it easier to grow in other parts of the world.

Singhi says, “By making strategic purchases of Genesis Luxury and Brooks Brothers, Reliance has formed brand partnerships with Burberry, Coach, Jimmy Choo, Diesel, Kate Spade, Michael Kors, Steve Madden, and others.”

But these purchases aren’t just limited to luxury brands. Singhi adds, “Reliance has also bought lingerie brands, like Clovia, for ten times its sales this year and Amante for the same amount in 2021. Aditya Birla also has licenses for many brands, such as Louis Phillipe, Van Heusen, Allen Solly, Peter England, Forever 21, etc.”

Both Aditya Birla Fashion and Retail Ltd and Reliance Retail Ltd play the game by the same rules. That is, to buy brands rather than make them.

The next step is to serve as many different price ranges of consumers as possible. And it is finally creating a market for designer clothes in the financially stable country.

Still, no financial choice is ever made without some doubt.

The biggest challenge for these companies is to make sure that, as they try to grow these designer brands, they don’t hurt the value of the leading couture brand.

After all, the designers have worked hard for years to get to where they are now. But right now, these investments sound like a good financial move for the industry as a whole.

edited and proofread by nikita sharma