Is there a way out of Sri Lanka’s strangling economic catastrophe with the help of the IMF and India?

Due to paper shortages, what happens if a country must postpone examinations? Amid an economic crisis, are power outages lasting more than 13 hours impeding hospitals from saving lives?

Those are the things Sri Lanka is going through right now, too. People on the island have had problems with everything from a Covid-19 lockdown to an organic-farming experiment that went wrong for their economic growth.

As a result, on April 12, 2022, Sri Lanka’s Ministry of Finance, which had never missed a debt payment since it became an independent country in 1948, said it would default on its overseas bonds, bilateral credits, and all loans in foreign currencies. The money will be used for things that happen quickly.

People have taken to the streets to protest against the government. The country’s economic problems will likely play a significant role in its politics. For India, Sri Lanka’s stability is essential from geopolitics and strategic point of view. But what can the country do to get out of trouble?

How Sri Lanka’s economic finances got worse

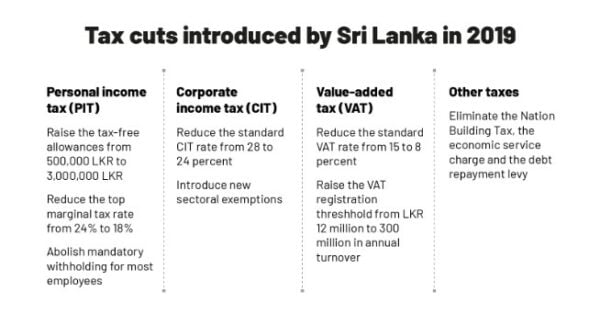

As of 2019 in Sri Lanka, tax cuts were made to help the economy grow again. In later years, the government had to bear the weight of the pandemic. It agreed to give money to affected people, and it made new promises to cover the losses of its biggest oil company, Ceylon Petroleum Corporation. The country’s debt-to-GDP ratio went haywire because of a drop in tourism dollars.

International Monetary Fund data shows that Sri Lanka’s debt-to-GDP ratio rose from 71.11% in 2012 to 114.1% by 2021, up from 71.11% in 2012.

During the same time, the ratio for India went from 68.55% to 89.6%. To put this in context, Indians and Sri Lankans had 70% and 86%, respectively, before the pandemic in 2019. This is how much Sri Lanka makes each year: about 3% of the Indian GDP, and Sri Lanka’s GDP is about $80 billion a year.

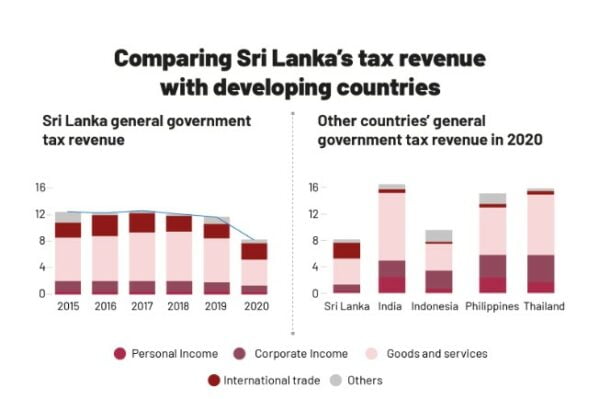

Debt built up over the last decade, and tax revenue has dropped recently, making its fiscal situation unsustainable. It went from 11.6% of GDP in 2019 to 8.8% in 2020, a significant drop.

When it comes to economic money, Sri Lanka is drowning in debt. And tax cuts aren’t making things better.

The Sri Lankan economic rupee has dropped by 30%. The country is paying more than three times as much in foreign debt servicing each year, with its current account deficit and fiscal deficit at record highs, so it has to pay more money each year.

Current account deficit: 3.8 percent of GDP in 2021. Fiscal deficit: 12.8 percent of GDP in 2020.

There is a current account deficit when the value of goods and services that a country imports is more than the value that it exports. Remember that the current account deficit is expected to be much more significant in 2021 than in 2020.

At the same time, bond yields are at 29%. There are no easy ways to do this.

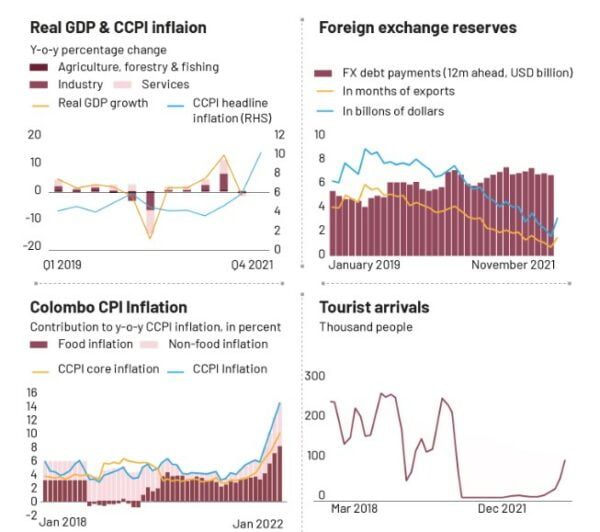

It’s not clear if Sri Lanka can pay back any of this money, and it looks like it’s going to be hard because one of its primary sources of income, tourism, is still coming out of the ashes of the pandemic.

Central Bank of Sri Lanka former Governor Ajith Nivard Cabraal said at the All-Parties Conference in 2022, “…the annual average foreign exchange inflow from the tourism industry fell from USD4.5 billion per year near-zero levels: there has been a severe decline in forex remittances since mid-2021. This is because of the Covid lockdown.”

The amount of economic money needed to pay off foreign debt each year has gone up from about USD2 billion to more than USD7 billion.

The above factors made it hard for Sri Lanka to pay back foreign debt, and the country didn’t have enough economic money to buy things like fuel and food.

Besides the pandemic and high inflation rate of 18 percent, other things like a drought in 2017 and a terrorist attack in 2019 made its fiscal situation even worse.

According to the most recent data, Sri Lanka’s fiscal deficit was still high in 2020 and 2021. It was 12.8 percent of GDP in 2020 and 11.4 percent in 2021.

There were significant changes to income tax and VAT in late 2019, and revenue losses were estimated to be more than 2% of GDP. Changes in policy made by Sri Lanka’s government, even though they were meant to help the country grow and create jobs, “further eroded fiscal space,” the IMF said in its Sri Lanka: 2021 Article IV Consultation report released March 25, 2022.

This will affect India

There is some concern about Sri Lanka’s impending debt default, but the Indian government is not too worried. An official from the government, who didn’t want to be named, says that repayments will be spread out over many years and can be changed.

“It’s in our best interest for Sri Lanka to be stable.” As a result, “the government has been helping, and they’re ready and willing to help again,” says a person who works for them.

Indians have been worried about Sri Lanka’s growing reliance on China for a long time. If Sri Lanka stops relying on China, that will align with Indian strategic goals.

India has been giving Sri Lanka money to buy food and fuel. So far, India has provided $1.9 billion in loans, currency swaps, and credits for things like food and fuel.

India gave Sri Lanka a currency swap worth $400 million in January 2022 as part of the Saarc Framework. It also gave Sri Lanka a new line of credit worth $500 million to buy fuel from India.

A credit line of $1 billion has also been set up to buy food, medicine, and other essential things from India.

All the economic money the Sri Lanka government has raised in dollars will now be officially gone. ” Because they don’t have forex reserves, and the economy has gone down so far that no dollars are coming in from the outside anymore. So, the government can’t pay back its debt, says Madan Sabnavis, the chief economist at Bank of Baroda, who says that’s not true.

If India has given economic money to Sri Lanka, it won’t come back any time soon, or it will have to be changed. When countries default, they usually don’t do it on purpose. They might pay back at some point in the future, but debt service will not be possible. As long as Indian banks have debt in Sri Lanka, they’ll have to pay it back. How much obligation they have is still up in the air.

If you work for an Indian company in Sri Lanka, you might have problems because the Sri Lankan rupee has fallen a lot.

Due to their small Sri Lanka operations, a few auto and food sectors companies could see some changes. This might affect shipping companies that get their business from shipments called “feeder cargo.” On the other hand, exporters of orthodox tea and ready-made clothes could see an increase in demand, or a rise in their prices, as Sri Lanka’s supplies dry up, says Somasekhar Vemuri, senior director, Crisil Ratings.

Only 0.6% of India’s total trade with Sri Lanka went to and from Sri Lanka last year. India exported $5 billion worth of goods to Sri Lanka and imported a $5 billion fortune from Sri Lanka, just 0.6% of India’s total trade.

Rising bank claims against the Sri Lankan government

The Sri Lankan government had a significant deficit and a lot of debt, so the Central Bank of Sri Lanka had to help with economic budget financing. At the same time, Sri Lankan banks had more sovereign exposure.

Between March 2020 and November 2021, the Central Bank of Sri Lanka’s net credit to the government went up by 9% of GDP.

“The government’s net domestic financing (NDF) needs rose to 13.3% of GDP in 2020 and are expected to rise to 12.3% of GDP in 2021,” the IMF said. This is compared to an average of 3.4% of GDP between 2010 and 2019.

The report said that in 2021, banks’ claims on the government and state-owned businesses would make up about 40% of all bank assets.

These links have made the country’s financial system more vulnerable.

Financial markets will be affected.

Financial markets are reflecting the general stress in the country right now.

Sri Lanka’s stock market fell, and the yields on its 10-year bonds rose from about 13% to about 29% on April 12, 2022.

The country’s main stock index, the S&P SL20, has dropped 43% since its highest point on January 24, 2022. Similarly, the ASPI, or All Share Price Index, of the Colombo Stock Exchange has dropped about 40% over the same time.

There has been a steady drop in the value of the Sri Lankan rupee, which was devalued by 15% on March 7, 2022. March 7, 2022: The value of the LKR dropped from LKR200 to LKR230 against the USD. This allowed for “greater flexibility” and a bailout from the IMF. In 2022, the USD/LKR rate was 322.29.

Pre-pandemic fiscal slippage, pre-existing debt problems, and the pandemic effect caused Sri Lanka’s EMBI (Emerging Market Bond Index) to quickly rise to 1,870 bps when the pandemic started, according to data from the IMF. At the end of January, the spread was above 2,500 bps.

The country’s foreign bonds were selling for about 60 cents to a dollar in the foreign market, which means they were selling at a discount of about 40%.

Because of these things, it’s almost impossible for Sri Lanka to get money from the private sector to help it.

The next step in my life

People in Sri Lanka think they’ll need about $3 billion to $4 billion over the next year to fight this crisis.

Sri Lanka will get economic money from India and China and a bailout package from the IMF worth about $4 billion to help it get through this crisis.

It got about USD2.8 billion from China during the pandemic and another USD200 million from Bangladesh.

Sri Lanka has already asked the IMF for a bailout package, which India did in the 1990s. This package will have to talk about cutting deficits, cutting subsidies, raising taxes, and opening up trade and liberalization. If you want to get a standard package from the IMF, this one is what you get.

Special Drawing Rights: It also got new money from the IMF in August 2021, worth about $780 million in today’s economic money. That cash, worth about $850 million, was used to pay off debts and buy foreign currency as of 2021.

Staff at the International Monetary Fund (IMF) have met with Sri Lankan officials to discuss Sri Lanka’s economic situation. The meetings, known as Sri Lanka Article IV consultations, allow the Fund to keep an eye on important economic indicators in member countries.