Dos and Don’ts for new Startups, 15 Things to Keep in Mind Before Approaching Investors for Funding

Dos and Don’ts for a Startup, 15 Things to Keep in Mind Before Approaching Investors for Funding

At some point of time, even the most healthy companies will need business funding. Startups must deal with startup costs, while established businesses must fund growth and working capital.

It’s common to choose Debt Financing, but your alternatives may differ based on the sort of business you run.

Its age, position, performance, market potential, team, and other factors all play a role. As a result, you should personalize your Financing search and strategy. Let’s go through how to perform a Financing search and some of the most prevalent alternatives.

Before contacting investors for finance, there are a few things to bear in mind.

1. Register your business in the name of a private limited company instead of LLP or OPC

It goes without a doubt that If you want to raise money for your business, you should use the private limited (Pvt. Ltd.) structure instead of LLP( Limited Liability Partnership) or OPC (One Person Company).

Most investors and Venture Capitalists prefer private limited businesses. The other two company kinds, Limited Liability Partnership (LLP) and One Person Company (OPC), are appropriate for anyone who wants to manage their business without having to rely on external finance and have complete control over all of the company’s operations.

The Registrar of Companies (ROC) must register a private limited corporation. A Certificate of Incorporation (COI) is issued when the registration process is completed. The Ministry of Corporate Affairs (MCA) has introduced a new fast-track registration process that permits companies to register with only one form.

The registration process is completed entirely online, and all documentation must be supplied electronically.

When a corporation registers itself like a private limited company, it becomes regulatory compliant. This attracts Venture Investors and private equity money to the company. Private tiny enterprises have an easier time receiving Bank Financing.

According to their perspective, a private limited company’s directors’ personal property would not be used to cover the company’s debt.

2. Compliance

You’re a busy person if you’re a startup founder or work in the C-suite of a new firm. It takes a lot of effort and late hours to start and build a business. Every technique, system, and process must be developed from the ground up.

Unfortunately, many companies overlook one important aspect: compliance in the midst of the commotion.

The private limited company setup must fulfil Ministry of Corporate Affairs (MCA) requirements in return for the ease of easily accommodating funds.

These include statutory audits, yearly filings with the Registrar of Companies (RoC), annual IT reports, quarterly board meetings, and the filing of minutes from these meetings, among other things.

You may believe that complying with regulations would slow you down, is too costly, or isn’t necessary. The fact is that you can’t afford to put compliance off, even if it’s time-consuming and costly. Compliance is one of the most crucial components of building a thriving, successful business, and if you don’t think about it early on, it will come back to bite you.

You can avert more significant and more catastrophic interruptions in the future if you start today. Systems and patterns of conduct will emerge similarly the way your organization expands, either by design or by force of habit.

You’ll have a lot tougher job modifying these systems and practices if you wait until you’ve developed substantially before implementing a compliance program. Everything will take longer and be more disruptive across the business, from aligning everyone’s goals to rolling up controls, procedures, and tools.

It’s crucial to be able to display that you’re at least moving toward a compliance program since if you have nothing to show regulatory authorities in the event of a compliance violation (e.g., a data breach), the repercussions might be considerably harsher. This is especially true for a small firm that lacks the financial stability to sustain fines and harm to its reputation.

Finally, commencing this effort early is critical since today’s B2B clients are sophisticated and need a thorough compliance program. Customer-driven audits are becoming more common. You won’t be able to conduct business with a substantial section of your target market if you don’t pay attention to data privacy, security, and regulatory compliance.

3. It is Better to have a Co-founder

It’s good to have a buddy at your side who knows you and shares your vision and enthusiasm in business, like it is in life. While doing it alone may give you a more extensive interest in the firm and more decision-making authority, having a co-founder provides its own set of benefits.

After all, a startup’s founding team must have expertise in all aspects of the business, which is only truly possible with a team.

It is pretty difficult to start a business. Running is considerably more complex and unpleasant. A 9-to-5 job requires significantly less time and effort than a startup. With so much at stake and frequent threats from the competition, it’s critical to have a partner in your journey who shares your vision and can be counted on, especially during tough times.

It is easier to receive funds for a startup with more than one founder. Investors are more probable to back enterprises operated by a team than those run by a single person. They are more inclined to support companies with numerous founders because they trust them.

If you want to make the fundraising process go more smoothly, it’s ideal to enlist the help of a co-founder or co-founders.

To accomplish various activities, several skill sets are necessary, and it is practically impossible for a single person to be proficient in all of them. It’s much easier if responsibilities are shared between two persons, with each person doing the tasks that he excels at, Jaiswal emphasized.

When it comes to funding, single founders are less desired, and this arrangement diminishes the likelihood of a startup’s success.

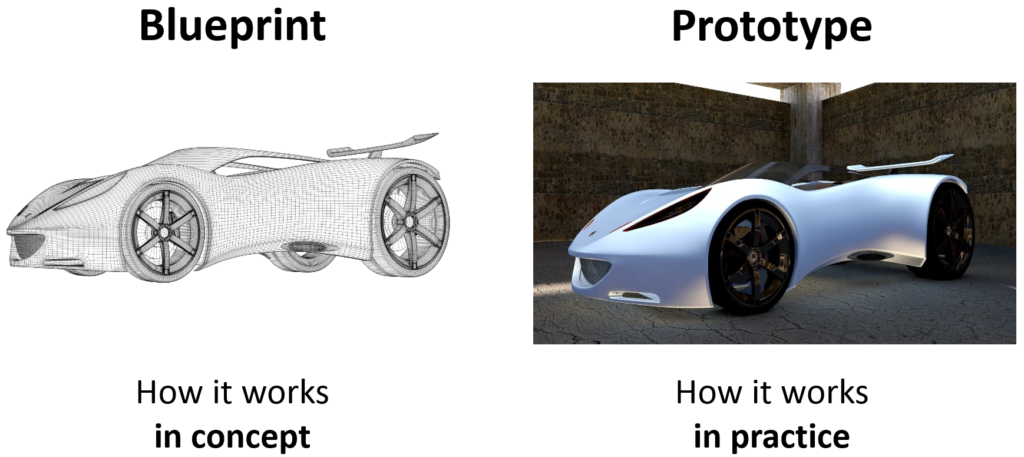

4. Having a good prototype will get investors to fund your startup

“According to the dictionary definition, a prototype is “an early model of a thing created to test an idea.” It acts like a reality check for a certain concept. When done correctly, prototyping displays all of an idea’s strengths and limitations, allowing it to be perfected before being implemented on a big scale.

Prototypes are frequently employed in several sectors, and you shouldn’t underestimate their value being a new entrepreneur. You probably wonder why. Because, we’ve seen, a humble attitude toward the solution and its prospective customers may save a lot of money and effort.

Working with startups has taught us that they have a proclivity to improve service by adding more functionality, which results in an overabundance of features that customers would never use.

Starting your product development journey with a prototype helps you to identify what consumers are lacking and what they would need while using the product in the real world.

A prototype in the context of a startup should be anything that helps you display not just the product but if the intended consumers of the product are enthusiastic about it similarly the way you are. A prototype is a tool that allows you to put your business’s numerous assumptions to the test.

A prototype should be a very rudimentary version of your product – just enough to give your customers a sense of what you’re working on or to show that your technology or invention works.

Entrepreneurs at the prototype stage frequently make the error of incurring expenditures like office space, capital expenditures like hardware, and so on. While a nice workplace is nice to have, during the prototype stage, it’s more important to optimize and focus costs only on the main goal — making a darn amazing product.

Also, it is not required to construct all of the features, especially the frills that make the product appear attractive, during the prototype stage. It is necessary to have a functioning prototype that allows the intended audiences to experience the product and gain a sense of the use case.

Take on just those expenses that will assist you in achieving the single goal of demonstrating that the technology/innovation works and/or that consumers find it valuable.

5. Proper Valuation of your startup

It’s critical to establish the company’s worth if you’re seeking to receive funding for your startup or thinking about investing in one.

Valuing a company’s assets is never straightforward. It is exceedingly difficult to give value to a firm with little or no income or profits and an unknown future.

It’s usually a question of multiplying earnings before interest, taxes, depreciation, and amortization (EBITDA) or other industry-specific multiples to value mature, publicly-traded companies with consistent sales and profitability.

However, valuing a new enterprise that isn’t publicly traded and may be years away from revenues is far more difficult.

A startup valuation is an estimate of how much a company is worth in the market based on a variety of criteria. When raising funds or seeking a technical cofounder, a business cofounder, or any partner or shareholder, valuing your firm is a process that every entrepreneur must go through.

It’s critical to have a realistic valuation for your firm because no investors or partners will be ready to invest if you overvalue it. Undervaluing your startup, on the other hand, implies you’re giving up a lot of equity in exchange for a smaller sum of money, or you’re undervaluing what you’ve already accomplished.

The worth of a startup is mostly determined by its stage and whether or not another party has made investment in it. When a startup reaches a certain milestone, its valuation will usually change.

6. Always book expenses from business account and not from your personal account

Starting a business is a thrilling experience. It’s a challenge since your days are unlikely to be long enough to do all you desire. As a result, you might think that having a business bank account isn’t a top concern. After all, establishing a business bank account to conduct your business isn’t required by law in many nations, so why bother?

Isn’t it just as simple as using your personal bank account to pay for company expenses? This could hardly be more untrue. Keeping track of your company spending in a business account may save you time and headaches.

Generally speaking, company costs are tax-deductible.

It simply implies that they can be deducted from your business’s income, lowering the profit on which tax is computed.

In other words, keeping track of your company spending will help save money on taxes.

It is unquestionably fantastic news, but keep in mind that the tax-deductibility of company costs is subject to several restrictions.

For example, you may need to buy a car for your business, but if you buy a Mercedes, the tax office may object to the purchase being tax-deductible.

As a result, it’s a good idea to evaluate the specific requirements for tax deductibility with your accountant ahead of time. Assuming you are motivated to lower your taxes, it is to your best advantage to keep your business and personal costs separate.

Having a company account is the simplest method to keep track of your costs.

The quantity and magnitude of your business costs will increase similarly the way your company expands.

Using your personal bank account for company costs may be discovered by your bank at some time. If this happens, your bank would almost certainly require you to utilize your personal account just for personal reasons.

You can choose to disregard this regulation, but you risk having your personal account canceled by the bank. If you decide to raise money, you may rest assured that investors will conduct due research on your company.

This will undoubtedly entail a study of your bookkeeping and accounting since investors are interested in learning about your company’s financial health (they may want to check your bank accounts).

Having a business bank account helps you to keep track of your money and bookkeeping, which may help you legitimize your firm and make discussions with potential investors go more smoothly.

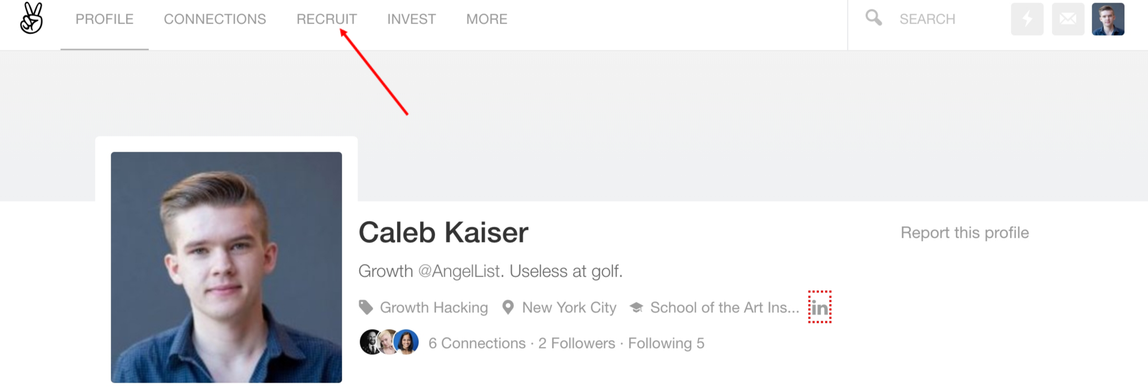

7. Create an AngelList profile.

If you don’t market your concept online, no one will know about it.AngelList is a great way to tell potential investors about your company and the products and services you provide. Once you’ve created an impressive profile, please share it with your formal and informal networks and ask for referrals.

This will allow you to quickly get to know a large number of investors, enhancing your chances of landing at least one important investment.

8. Make a list of potential investors with whom you may share your ideas.

If you have a list of prominent personalities in mind with who you’d like to meet and discuss your thoughts, make a note of them. After you’ve made your choice, go to several experienced entrepreneurs and ask them to shortlist the names that look most fit for your business.

Getting help from experienced entrepreneurs will be a win-win scenario for you since you will not only master the art of picking investors, but you will know which investors are worth your time ahead of time.

9. Improve your networking abilities.

You’ll have a strong chance of securing money if a well-known individual suggests your business proposal to an investor. After you’ve narrowed down your list, study each investor thoroughly to see if you have any shared contacts.

Once you’ve found them, meet with them face to face and explain how your business differentiates from the competitors. As a consequence, your mutual connection will be more confident in pitching your ideas to the investor.

10. Have a classy beginning.

They believe the first impression is the final impression. When it comes to pitching your company to possible investors, you need to make sure that your emails are both succinct and enticing to the investor. In addition, the way a draught message is written will vary from one investor to the next. As a result, you’ll need to pitch carefully and separately.

11. Tell them why they should back your company.

Founders seek to find the best investors, and vice versa, to keep the firm cycle going. If you reveal your long-term business aim and plans early on, it shows how passionate and devoted you are about your company and how promising it may be for them if they decide to make investment.

There is no surefire strategy to get money from investors, but the most crucial component is perseverance. Many people will say no to you, but don’t let that deter you. Even if you don’t hear back from the investor, maintain in touch and keep them updated on the status of your firm.

Things to think about before taking out business loans What you should not do

Unfortunately, finance and investment need money, and money encourages exploitative business practices, frauds, and other forms of deception. So, to assist you in avoiding the mistakes, here are some pointers.

12. Be wary of where you receive your money from

Just because Private Placement, angel investors, friends, and relatives are referenced here or in another source of information doesn’t mean they’re excellent sources of investment cash. Some investors are great moneymakers, while others aren’t. These lesser-known investment options should be addressed with extreme caution.

13. Get it down on paper.

Never spend someone else’s money without doing the extensive legal study first. Hiring a professional to handle the paperwork is a good idea, and double-checking that everything is signed is good.

14. Don’t spend money until you receive funds

Never pay for anything that has been promised but never delivered. Businesses frequently receive cash assurances and embark on cost-cutting contracts, only to have the funds fall through.

15. When you’re in a bind, don’t turn to your friends and family for help

It’s important to remember that borrowing money from friends and family isn’t always a good option. When your company is in trouble, the last thing you need is friends and family abandoning you. You face the risk of losing all of your friends, family, and business at the same time.

Myths about small business finance

Let’s clear some common funding fallacies before we get into the most feasible solutions for startups and existing enterprises. Don’t become discouraged at this point. Dealing with realities that you can work with is better than dealing with lies that you can’t.

i)Venture finance is becoming a more popular way to Fund companies.

Venture capital investment is, in fact, relatively uncommon. I’ll go into more depth about this later, but I’m guessing that only a tiny number of high-growth companies with high-powered management teams are Venture Candidates. Many individuals use the term “Venture Capital” to refer to “outside investors” or “angel investors” when they truly mean “outside investors” or “angel investors.”

ii) A bank loan is the most probable source of finance for a new business.

Banks, on the other hand, do not make investment in new businesses. Because of the danger, banks are not supposed to make investment depositors’ money in new companies. We’ll go over that in more depth later, but getting a bank loan nearly usually requires some sort of financial backup.

iii) Investors are attracted to business proposals.

Business plans alone will not persuade investors to make investment in your company.

Yes, a well-written and clear business plan (and pitch) give investors a thorough overview of your company.

Nevertheless, they are investing in your business, not just the plan. In most cases, you’ll need to assemble a team and make progress toward idea validation or, better still, traction (paying customers). As a result, attracting investors will need an important amount of work.

Nobody puts money into plans or ideas. There are few exceptions, like when investors are familiar with an entrepreneur and are willing to make investment in them early on. In this case, they’re investing in the entrepreneur rather than the concept.

How to Find Investors in India for a Startup

Angel investors and Venture Capitalists are unable to show enthusiasm for every proposal they get from entrepreneurs. On the other hand, even inexperienced entrepreneurs with distinctive ideas do not need to interact with hundreds of investors in order to acquire funding in the early stages. Getting investors for your business in India is now easier and faster than ever before.

Financing is a Difficult task

When starting a business, most people use their home equity or savings to fund it. This is known by the term “bootstrapping.” Only a few high-growth companies are able to secure outside funding.

Deals involving venture money are exceedingly unusual. Borrowing will always be contingent on collateral and guarantees, rather than on business strategies or concepts.

And while business borrowing is common for established companies, it is not a common alternative for startups.

What you should do next is very dependent on your individual business. In general, high-tech companies should look for angel funding or ask friends and family first, but on the other hand established enterprises should seek their small business banking first. But keep in mind that your company is unique.