Despite Fall In Economy, Increasing GST, Taxes & Lowering Interest In Banks & EPF, Government Has Made Kashmir Files Tax Free? Why So Much Support To Controversial Movie? Will This Movie Help Government Do More Polarization For 2024 Elections?

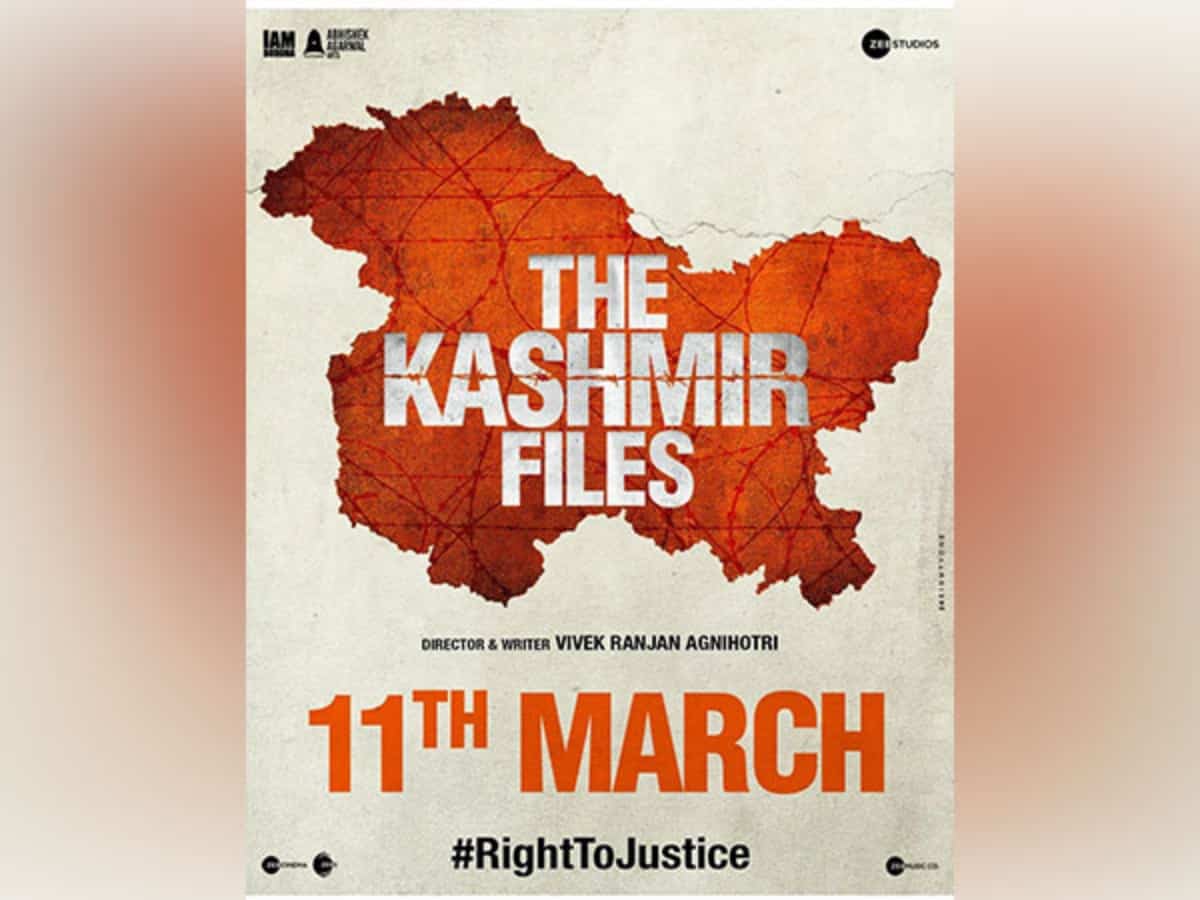

Vivek Agnihotri’s film ‘The Kashmir Files‘ has garnered a lot of great feedback across India. The picture, released last Friday (March 11), has been designated tax-free in four states.

The film is exempt from paying entertainment tax in 5 States, Karnataka, Madhya Pradesh, Gujarat, Uttar Pradesh, and Haryana.

The movie’s ticket prices would be reduced due to the tax-free status, as the states have waived the entertainment GST. The current GST rate for entertainment is 18%, and after subtracting the state GST from ticket costs, they will be reduced by 9%.

See also, Top 10 Ways To Save Income Tax In 2022 While Getting Higher Return

Different Point of views on Kashmir Files being tax-free

Positive views

While Bommai described the film as a “blood curdling” and “poignant” story, Chouhan described it as a “heart-wrenching portrayal” of Kashmiri Pandits’ sorrow and suffering in the 1990s.

Khattar said he viewed the film in a theatre on Sunday night. He stated that he made the picture tax-free for our generation to experience this “vibrant flick.”

“The film ‘The Kashmir Files’ depicts the human catastrophe that occurred in the Kashmir Valley in 1990 in a vivid and moving manner. It was my good fortune to serve for the organization in Jammu and Kashmir for a long period, seeing and understanding firsthand the hardships and conditions of the people there “His tweet stated.

Sunil Kumar Pintu, a member of the Janata Dal (United), has also urged that the film be declared tax-free, claiming that it depicts the struggle of Kashmiri Pandits.

Negative Views

However, detractors claim that the exemption provided to the Vivek Agnihotri picture is owing to political considerations, as the Karnataka government rarely gives other language films tax exemptions.

Karnataka has stated that the film “Kashmir Files” will be tax-free, joining other BJP-ruled states such as Gujarat, Madhya Pradesh, and Haryana. Some in the Kannada cinema industry have questioned the move, claiming it was made for ideological purposes. Vivek Agnihotri, who is deemed right-wing due to beliefs he has publicly espoused in the past, directs Kashmir File, which focuses on the exodus of Kashmiri Pandits due to insurgency.

A senior director who does not want to be identified told TNM that he did not want to remark or give weight to the film, which he described as “made by a lousy director and pushed because it is propaganda.” Another actor stated that he did not want to openly criticize the tax exemption because she is concerned about the backlash she may receive from the government and her Kannada film industry colleagues. “In contrast to the Tamil and Malayalam cinema industries, Sandalwood has a lot of right-wing sympathizers,” she remarked.

“There is no doubt that this is a propaganda picture, made by a right-winger and funded by a right-wing government,” claims B Suresha, a famous Kannada director. “We have a lot of deserving films, but they don’t get special treatment.” The problem is that they no longer even try to hide their views. An MLA recently stated that the Red Fort would be draped in a saffron flag. And the right side has a majority in the Kannada film business, and the majority always rules, so we can’t even fight it,” he remarked.

See also, Various Point of Views on the Hijab Row Verdict

Positions of Opposition Parties

Let’s look at some of the opposition’s arguments on why Kashmir files should not be taxed.

Danish Ali, a member of the Bahujan Samaj Party (BSP), argued that films that incite hatred, whether “Kashmir Files” or “Gujarat Files,” should be banned.

Following a series of tweets by the Congress’ Kerala branch on the emigration crisis and the film, BJP leaders claimed the opposition party lacked empathy and sympathized with only one community for minority appeasement.

The unit blamed the migration of Kashmiri Pandits from the Valley in the 1990s on the BJP-backed V P Singh government and then-governor Jagmohan.

“It is in the DNA of the Congress that the party and its leaders understand the pain of only one community for the sake of their agenda of minority appeasement,” Union Minister Giriraj Singh said, referring to the Congress and its leadership.

“Sonia Gandhi can cry over the Batla House encounter, but she doesn’t cry for our Kashmiri Pandits,” he stated.

It’s worth mentioning that “Over a lakh Kashmiri Pandits left the Valley under the watchful eye of Congress dispensations,” BJP MP, KJ Alphons stated. “On communal grounds, they were ejected from their homes.”

Is it possible that this is just a propaganda film and other reasons for its tax-free status?

The Kashmir Files, in my opinion, is a complete fabrication and a series of lies produced by the Sangh Parivar to incite hatred toward Muslims and polarised society.

The migration of Kashmiri Pandits was sparked by BJP J&K Governor Jagmohan, who Vajpayee and Advani selected during their party’s support for the VP Singh government. Through government-sponsored propaganda, Jagmohan created fear among Hindus. An exodus ensued as a result of the panic.

In the years leading up to the KP exodus, Pakistan-backed pan-Islamic militants in J&K killed roughly 15,000 Muslims and 300+ Hindus. That should tell you something about the scope of the deception in this BJP/RSS-backed film and its stale ‘Hindu khatre mein hai’ agenda…

Did you know the current status of the GST Council intending to raise the GST tax slab from 5% to 8%?

According to a report, The Goods and Services Tax (GST) Council is expected to hike the lowest tax band to 8% from 5% at its next meeting.

To increase collections and reduce states’ reliance on the Centre for compensation. A committee of state finance ministers may report to the council by the end of March on various revenue-raising alternatives, such as raising and streamlining the lowest slab. The GST is now a four-tiered system with 5, 12, 18, and 28% tax rates.

GST now has a four-tier slab structure with tax rates of 5%, 12 per cent, 18 per cent, and 28 per cent, respectively.

Necessities are privileged or taxed at the lowest rate, whereas luxury and detriment items are charged at the highest rate. On top of the total 28 per cent slab, luxury and sin things attract a cess. The same cess is used to reimburse states for revenue losses incurred due to the implementation of GST.

The increase in the tax slab from 5% to 8% could increase to Rs 1.50 lakh crore in annual collections. According to the calculations, a 1% increase in the lowest bracket would explicitly include packaged food goods, resulting in a revenue increase of Rs 50,000 crore each year.

Furthermore, the group of ministers appears to be constructing a three-tier GST framework, with new rates of 8%, 18%, and 28%.

If the proposal passes, all goods and services currently taxed at a rate of 12% will be subject to an 18% rate. At the same time, ministers debated whether or not to include more items in various tax brackets and whether or not to eliminate GST-exempt items. Unpackaged and unbranded food and dairy products are currently exempt from GST.

By way of the GST compensation rule, which expires on July 1, 2017, during the implementation of GST on July 1, 2017, the federal government committed to compensate states for five years, until June 20, 2022, and save their money at a rate of 14 per cent per year in this base year revenue of 2015-16.

However, the revenue-neutral rate was cut from 15.3 % to 11.6% over the last five years because of GST reductions on numerous items.

Another thing is TDS and TCS rates on non-salary payments.

The government is searching for comfort, and if any benefit is lost in the process, they will seek credit. They believe that anything that goes wrong is not their fault.

People, particularly the middle class, are on the receiving end, i.e. whatever occurs, the government and its legislative and executive branches are entirely unaffected by the policies, including any adverse effects.

The government decreased TDS and TCS rates for interest, dividend, rent, and other non-salary payments by 25% by the government in May 2020. The government did this to increase money in the hands of individuals, particularly those experiencing financial difficulties due to the coronavirus-induced lockdown. TDS and TCS rates on non-salary payments were reduced on May 14, 2020, and will remain in force until March 31, 2021.

As a result, the TDS and TCS rates on these non-salary payments will revert to their previous (higher) levels on April 1, 2021.

This means that if the interest paid on a bank fixed deposit exceeds Rs 40,000 between 2021, April and 2022, March, the bank will deduct tax at a rate of 10% rather than the previous financial year’s 7.5 per cent.

The Lowest In Four Decades, EPFO Sets Interest Rate On EPF Deposits At 8.1 Percent For 2021-22.

According to reports, EPFO, the retirement fund agency, decided on Saturday to decrease the interest rate on provident fund deposits that will be increased to 8.1 per cent in 2021-22, down from 8.5 per cent in 2020-21. Since 1977-78, when the EPF was 8%, this is the lowest interest rate.

“In its meeting held on Saturday, the Employees’ Provident Fund Organisation’s (EPFO’s) apex decision-making body Central Board of Trustees resolved to provide an 8.1 per cent rate of interest on Employees Provident Fund (EPF) for 2021-22,” a source said. Following the CBT decision, the interest rate on EPF deposits for 2021-22 would be transmitted to the Ministry of Finance for approval.

The finance minister ratified it in October 2021, and EPFO issued instructions to field offices to credit interest revenue at 8.5 per cent to subscribers’ accounts for 2020-21. The interest rate on EPF deposits for 2021-22 will now be sent to the Ministry of Finance for approval following the CBT decision. EPFO only provides the interest rate after being approved by the government through the finance ministry.

See also, EPFO to take call on interest rate for 2021-22 in March

What is causing the decline in FD rates?

One cause for the decline in FD rates could be that banks have boosted liquidity due to the increase in cash deposits by consumers. Many banks received large cash deposits due to the government’s demonetization move. According to reports since the announcement, the Reserve Bank of India (RBI) and other banks have received deposits totalling more than Rs 5.11 trillion.

Because a large portion of these deposits is held in savings accounts, banks are required to provide a minimum of 4% interest to account holders. They attempted to offset the cash outflow by lowering the rates on FD accounts. Because of the large infusion of cash, banks will have more capital to lend to their consumers.

As a result, a reduction in deposit rates is frequently accompanied by a decrease in lending rates. The MCLR (marginal cost of funds based lending rate) has decreased due to the lower FD rates. This is excellent news for people who need to borrow money from a bank. On the other hand, The average investor who merely wants to save money and gain more from their investment is left out in the cold.

Now, don’t you think that despite a slump in the economy, higher GST and tax rates, and lower interest rates in banks and EPF, the government has made Kashmir files tax-free? Why Is There So Much Love For A Controversial Film? Will this film assist the government in increasing polarization in the run-up to the 2024 elections?

Amid all controversies, Kashmir files have unearthed agonies and the tales of a mass exodus of the families of Kashmiri Pandits from the Valley. However, the depiction of the plight is a bit wary and raises the eyebrows of every segment of society. But, It has incited a sense of uneasiness on both sides of the community.

Is it provoking or rectitude to patronize a controversial movie by making it tax-free by the Modi government?

Is it tax-free because it suits the narrative of the BJP, or is it a story worth discussing to learn lessons from our past? Has it divided society or unified us towards social harmony?

The time will only tell, but one thing is for sure, several hundred families still await to get relocated in their homes and cry out for the development of the Valley.