An interesting neo banking startup announced a funding of USD 100 million

A neo banking startup has announced its funding! What pleasant news it is.

Let us talk about neo banking. First of all, we should be aware of what is neo banking. Neo banks refer to the use of online-only financial technology, which is basically the fintech companies that have their operations only on digital means or through mobile applications. In simple words, neo banks can be referred to as digital banks which have no physical branch. The concept of neo banking is bringing a change, a disruption in the traditional banking system by using technology and artificial intelligence. This is done so that personalized services can be provided to the customers.

In other words, neo banking makes the use of a design thinking approach in solving a particular area of banking and then provides products and services tailormade in a way that makes banking simple and convenient to the final customers. The different areas of banking can be remittance, money transfer, acquisition of customers, utility payments, and personal finance. The term neo bank became famous in the year 2017 around the world. This concept of neo bank rose up when there was a challenge to the traditional banks in the terms of connectivity, customer engagement, reach, and the end experience.

Now it is genuine that a question may arise, whether neo-banks have the ability to replace the traditional banking system? The answer to this is NO. Neo-banking cannot replace the traditional banking system entirely. First of all, neo banks only provide services for a small range of offerings. The neo banks are fully digital. They may not be able to fulfill the needs of those customers who are not into technology or are not tech-savvy. Still, there are many customers who believe in face-to-face interaction and traditional banking works best for them.

Let us now talk about the funding of a neo-banking startup that has taken place recently. Before this startup, many other neo-banking startups have also announced their funding. In October 2021, Open announced a funding of USD 100 million. That round of funding was led by Temasek, which is a sovereign wealth fund of Singapore, and the other investors in that round of funding were Google, which is a major in technology, Visa, a card operator, and SBI Investment of Japan. The startup has been reported to be in conversations to raise fresh funding worth between USD 100 -150 million, which will take the value of the startup between USD 1 billion to USD 1.3 billion.

In January 2022, the startup IndMoney had raised funds worth USD 75 million. That round of funding was led by Steadview Capital, Tiger Global, and Dragoneer Investment Group. After this round of funding, the value of the startup was USD 640 million. In August 2021, another startup, Jupiter, which is started by Jitendra Gupta, who is a veteran in the fintech sector had raised USD 45 million. These startups are bringing disruption in the banking sector.

Announcement of funding of a neo-banking startup

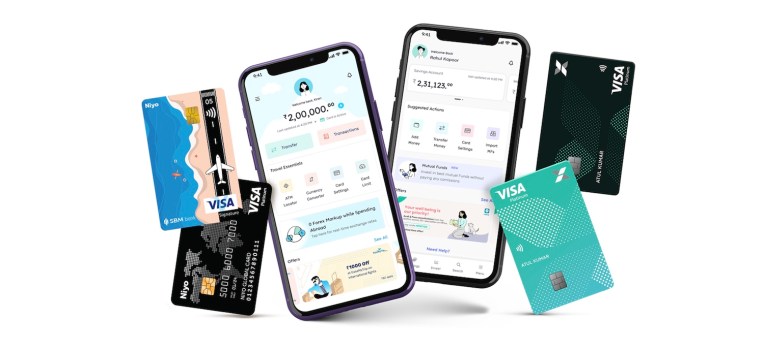

The startup, Niyo has raised funds worth USD 100 million, as announced on February 24, 2022. This round of funding that has taken place is the new round of funding which was led by Accel and Light rock India. The other participants of this round of funding were both new and existing investors. The new investor who joined the startup by taking part in this round of funding was Beams Fintech Fund. The existing investors who were a part of this round of funding were Prime Venture Partners and JS Capital.

The startup is planning to use the funds raised in the launching of its new products in the domains of both lendings as well as insurance. The startup is also planning to use some amount of the funds raised for the building of brand, inorganic acquisitions, and even strengthen its team. The startup currently has around 500 employees, and the plans of the startup consist of doubling this count by the end of the year 2022.

About the neo-banking startup that has announced its funding

The startup, Niyo was founded in the year 2015 by Vinay Bagri and Virendra Bisht. The startup has its focus on creating banking that is simpler, smarter, and safe for the customers by simplifying finance with technology.

The values of the startup are as follows-

Bias for action- Whenever the opportunity presents itself, the aim of the startup is to make decisions quickly and act upon them.

Customer focus- All that the startup does is with the customer in mind.

Innovation- The startup brings new ideas to the table and brings them to fruition.

Integrity- The startup does not take shortcuts. Honesty is at the core of everything the startup does.

Ownership and Teamwork- The startup takes responsibility for what it does, works collaboratively, and ensures that everything is seen to the end.

The startup has a partnership with several banks and financial institutions and also issues travel cards in partnership with SBM and DCB Bank for international remittance. The different products offered by the startup are Niyo Global, Niyo Money, and Niyo Bharat. The startup currently has around 7000 corporate partners.

The startup as of now has around 4 million users. The startup has claimed that it will be adding around 10000 new users on the daily basis, and has the aim to have around 30 million customers in the time period of the next four years. The startup last year had acquired a startup, Index, which is a startup based in Bengaluru, Karnataka. This was done to expand its wealth management platform. In July 2020, the startup has also acquired Goalwise, which is a mutual fund startup. The investors of the startup are Tencent, Prime Venture Partners, JS Capital, and Horizons Ventures.

About the founders of a neo-banking startup

The startup, Niyo was founded by Vinay Bagri and Virendra Bisht.

Vinay Bagri is the CEO of the startup, Niyo. He has experience of around 18 years in the corporate world while working in different organizations like ICICI Bank, 3M, Parle, ING, Standard Chartered, and Kotak Mahindra Bank. He likes playing badminton in his free time and is excited to learn salsa dancing.

Virender Bisht is the CTO of the startup, Niyo. He has experience of 16 years in the creation of world-class software products. He likes running in his free time and is engaged in expanding his knowledge of music.

The startup is working dedicatedly towards our traditional and old banking system, helping it bring a change in today’s world which runs by technology. We wish the startup a stroke of good luck and a bright and successful future ahead!!

Edited and published by Ashlyn Joy