Why is Paytm’s stock falling : A New Target For Paytm,Stocks Will Drop Another 25%

Why is Paytm’s stock falling : A New Target For Paytm,Stocks Will Drop Another 25%

One97 Communications, Paytm’s Parent company, is a financial technology and e-commerce startup based in Noida, India. Vijay Shekhar Sharma started it in the year 2000. One97 Communications is valued at $16 billion as of June 2021, making it one of India’s most valuable unicorn enterprises.

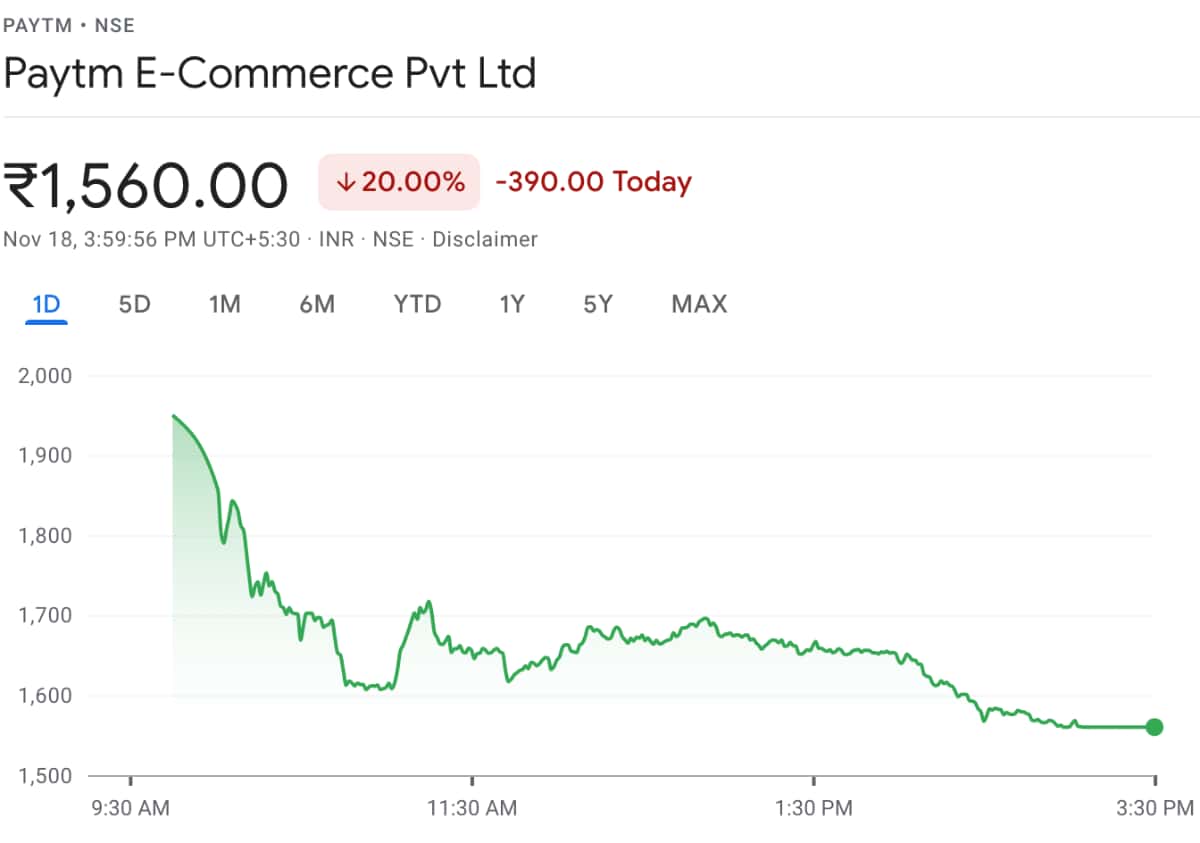

One97 Communications’ disappointing public market debut on November 18, 2020, Paytm’s parent company is planning to be a full-stack financial services company with a presence in the whole digital payment ecosystem, e-commerce and financial services. However, the company’s vision statement, which it used to go public last year, has proven to be just that.

The share has fallen due to the announcement that Reliance Jio will launch in a phased manner over the next three months, leading to some confusion among users. After all, even before this, the shares of both Paytm and rival Ola were at their lowest levels in history.

And that’s despite Jio’s share of the market being relatively low. In the last year, Jio’s share of the smartphone market has been under 6%, but Jio has also gathered a larger number of paying customers.

Paytm’s stock has plummeted following India’s largest Initial Public Offering, presenting a costly lesson for the company’s early investors.

Paytm’s stock has dropped 58 percent since it went public on November 18. As a result, the company’s parent, One 97 Communications Ltd., is now valued at $7.8 billion, down from $20 billion.

According to sources familiar with the subject, SoftBank Group Corp. invested $7 billion in the Indian startup in 2017. Berkshire Hathaway Inc. invested in One 97 when it was valued at more than $10 billion in 2018, and T. Rowe Price Group Inc. invested the following year when it was valued at $16 billion, according to the sources.

Paytm is having trouble persuading investors and experts of the digital payment giant’s business model’s viability. Due to growing expenditures, losses extended to 4.74 billion rupees ($63 million) in the July-September quarter from a year before. During a global markets selloff, the company’s stock has collapsed, casting a fog on technology’s prospects.

companies planning to go public in India. More than 40% of companies that sold their Initial shares in India last year were in the red.

Although Paytm was quick in acquiring new customers as it grew, they weren’t buying the same type of devices. In an effort to become a technology leader in the mobile commerce space, Paytm has made the decision to focus its efforts on iOS and Android devices.

While this is not obvious from the numbers that we have been posting, these are important indicators that Paytm is a serious player in the space.

For the time being, the stock price has been volatile.

Paytm’s dabbling in numerous business lines, according to the Market experts, prohibits it from being a category leader in any area except wallets, which is becoming less important given UPI’s meteoric development as a digital payment option.

Paytm’s effective cost of SoftBank’s 17.47 percent investment in the firm is Rs 800 per share, while Ant Group’s is Rs 330 per share, according to an email from the company’s spokesperson, who declined to comment more on valuations. On Friday, the shares finished at Rs 903.05. Ant, owned by Jack Ma, is the largest stakeholder, owning a quarter of the company.

T. Rowe Price and SoftBank declined to comment, while Berkshire Hathaway and Ant did not reply to demands for comment.

Paytm’s IPO, which was priced at the top of a marketing range, garnered $2.5 billion. It was one of the worst debuts by a big technology company since the late 1990s dot-com boom. According to the offer paperwork, pre-IPO investors have a one-year lock-in period that ends in November. Paytm offers digital loans, insurance, and wealth management among other services.

That memo set a negative objective for the stock, which had already finished Day 1 at a 27 percent discount to its issue price of Rs. 2150.It can be said that Paytm’s business strategy is disjointed and unfocused. Analysts normally establish price objectives for a 12-month period, however in this case, Paytm beat the price target on Day 1 by plunging to Rs.1,564.

When the stock was trading at Rs.1,564 in December, Market experts and analysts repeated their objective of Rs. 1,200. Then they lowered their price objective to Rs.900 on January 10, when the stock was trading at Rs.1,254 levels. On January 24, two weeks later, the stock dropped 8% intraday to Rs.881.5.

Following the release of the Q3 earnings on February 7, the analyst lowered thier goal to Rs.700, a 25% drop from the February 9 close price of Rs.941.

The significant loss of Rs.780 crore recorded in the third quarter, followed by high stock option costs of Rs.390 crore, forced Market analysts to cut their price estimate by 25%. Because accounting requirements require Paytm to recognise the cost of employee stock options (ESOPs) as an expense, the impact on the company’s bottom line is only growing.

The business had issued roughly 28 million ESOPs just before to its IPO, which is projected to result in a recurrent annual charge of around Rs.1,600 crore because the awards are deep in-the-money with an exercise price of Rs.9 versus the IPO price of Rs.2,150.Before this, increased option fees were not considered into forecasts.

Minority shareholders must indirectly absorb the expenditure of the stock options because they were offered at a minimal exercise price that favoured employees.

Based on the assumption that the 27.5 million ESOPs granted at Rs.2,150, 76 percent of those stock options were awarded to founder and CEO Vijay Shekhar Sharma, the market experts arrived at the Rs.1,600 crore cost. Based on the inherent worth of assessing ESOP expenditures spent by the employer, that’s a total outlay of roughly Rs.6,000 crore over five years.

Over the next five years, this equates to around Rs.300 crore every quarter. As a result, it’s not unexpected that Paytm is amortising ESOP expenses at a rate of about Rs.390 crore every quarter.

This expense might rise even higher when more ESOPs are granted.

Paytm’s business strategy, particularly its distribution sector, has been criticised by various market experts. The loan distribution business is still small, with the company distributing only 39,000 merchant loans, accounting for only 2% of total loans by volume.

While Paytm disbursed 60,000 personal loans in Q3, 98 percent of the loans by volume are in the Buy Now Pay Later category, with ticket values under RS.3,000. Paytm’s main roadblocks are its inability to lend on its own balance sheet, its apparent lack of a distribution plan, and the scalability of its merchant loan portfolio.

It is now anticipated that the stock will fall down to Rs.700 in the next 12 months after accounting for bigger losses.

Edited and published by Ashlyn Joy