An interesting savings application startup announced a funding of USD 32 million

Have you ever imagined having a savings application? An application that regulates how much you save! Isn’t it amazing!!!

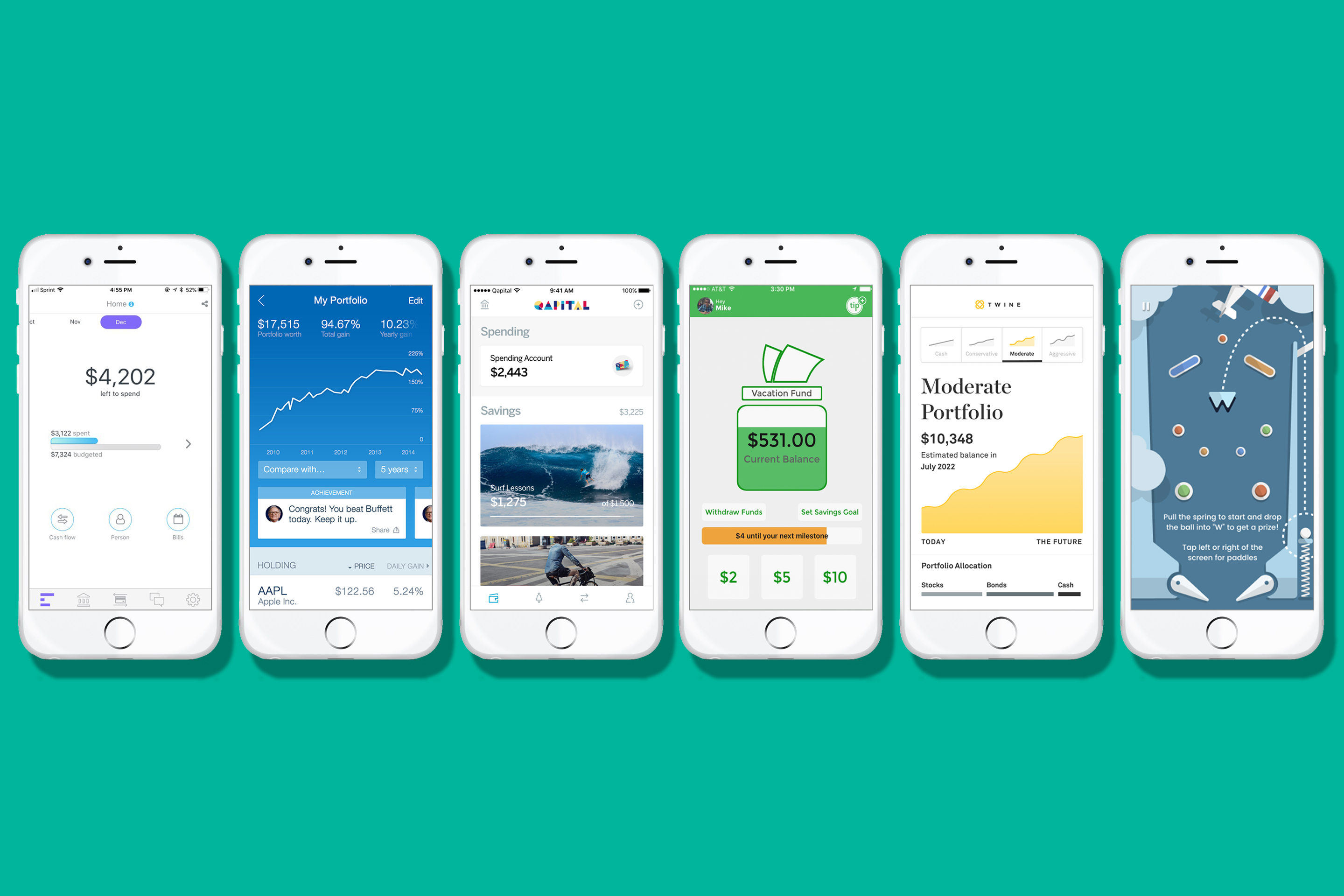

Let us talk about savings applications. As fancy as it sounds, a savings application is the one that has the focus to encourage the users to save money and track their expenses. This is one with the aim that the user can meet his financial goal over a period of time. The savings application also provides the feature of providing the users with a detailed record and calendar view for the progress of savings.

Such applications make the use of sophisticated technology that helps in the calculation of how much a user can afford to save and then it helps the user in eventually doing it automatically, through moving money from the bank account to the virtual saving account. The logic behind all this is that the saving starts without the user actually getting to notice that the cash is not there in the account.

Let us now have a discussion on the funding of a savings application startup that has taken place recently and is all over the news.

Announcement of funding of a savings application startup

The startup, Jar has raised funds worth USD 32 million, as announced on February 05, 2022. This round of funding that has taken place and we are talking about was the Series A round of funding and was led by Tiger Global. The other particupants of this round of funding were the mix of new investors and old investors. The new investors included Rocketship.VC, Third Prime, Stonks, and Force Ventures.

The existing investors who were a part of this round of funding were Arkam Ventures and WEH. Many angel investors also were a part of this round of funding. They included Victor Jacobsson, who is the founder of Klarna, Suleman Ali who belongs to the Ali Capital, Shamir Karkal, who is the founder of Sila Money, and Byron Ling, who belongs to Canaan Partners.

What to do with the funds raised? The startup is planning to use these funds in offering lending and insurance to its users. The startup also has the plans to use a portion of the funds raised in improving the distribution and bringing in the savings habit among its users. This it does through gamification. The valuation of the startup after this round of funding has shooted up to USD 200 million. The startup in September 2021 had raised USD 4.5 million in another round of funding.

About the savings application startup that has announced its funding

The startup, Jar was founded in May 2021 by Misbah Ashraf and Nischay AG and has its headquarters in Bengaluru, which is called the Silicon Valley of India. In the age where protection of consumers and easy gratification eventually leads to wallets and souls being empty, the startup has its focus to help millions of Indians rediscover the undeniable, cumulative advantage of saving every single day. The startup wants to bring back to this generation the concept of piggy banks by assisting them to save in digital gold and staying bank sceptic so that no matter who a user banks with, they always have Jar application to save with.

The mission of the startup is as follows-

Educate the youth- We are unfortunately never taught in schools how to handle and save money. Even young Indians have no defined rules or models to follow. They are many reasons why the youth today do not save but the top reason is that they have no clear understanding of how it actually works. The startup wants that the savings on its application are an intuitive and easy experience for all its users.

Make savings a habit- By helping the customers save a little bit every day, it wants to normalize savings as being a part of the lifestyle of the users until it becomes like financial muscle memory. The startup just asks the users for one-time authorization, post which the most challenging part of habit formation is automated by the application.

100% convenience- The startup wants to make the whole journey of daily savings as frictionless and seamless as possible. This way the customers of the startup can save daily while focusing on other aspects of their busy life.

Keeping it positive– The startup wants to make positive changes in the lives of the users. It wants them to enjoy a jargon-free platform that encourages them to save without scaring them into it. The startup does not believe in what-ifs as an incentive to save, it wants its users to save because they will be hence doing their future self a great solid.

Small amounts only- The startup does not believe in making deep cuts into its users’ pockets. It only rounds their spending off to small amounts like 5 or 10. This way the users never feel the pinch and the burden of saving every day but still enjoy all the benefits as their savings keep on increasing by the day.

The startup launched its gold-based savings product in June 2021. The startup in September 2021 had 400000 customers and now it has around 4.7 million customers.

What has been said about the deal of funding?

What has been said about the deal of funding?

Nischay AG, who is the co-founder of the startup, Jar made a statement saying that the startup has seen amazing growth. He disclosed that the platform processes around 100 transactions every minute. He then said as the habit is being cultivated, the startup is seeing an increase of 20% in investments from users on a month-to-month basis.

He then said that the financial literacy among the people of our country is pretty low. He said they need proper education and a habit to save money. He then said that the startup is now putting its focus into that. He then told that at the end of this year, the startup will be launching two more financial products.

We all know how important and crucial it is to save money in order to have a safe and tension-free future. The startup is helping the people of our country in doing that. It is highly appreciable of the noble work it is doing. We wish the startup a stroke of good luck and hope it is able to achieve its mission and has a shining and safe future ahead!

Edited and published by Ashlyn Joy