New FinTech Companies are racing to replace old banks. Is it possible?

The year 2015-2020 has witnessed an extraordinary growth of new start-ups in FinTech companies across India, particularly in digital payments, lending and wealth sections. According to the ‘MEDICI India FinTech Report 2020‘-India has the second-highest number of fresh such companies in the last three years after the US.

What is a FinTech company?

According to the Financial Stability Board (FSB), FinTech is defined as “technologically empowered financial innovation that could occur in new business models, applications, processes, or products with an associated material effect on financial markets and institutions and the provision of financial services.”

Presently, there are more than 2,000 such companies in India. The Boston Consulting Group in its recent report has declared that there will be a $100 billion value creation occasion and India is firmly poised to recognise such a sector valuation of $160 billion by 2025.

The method of valuation for FinTech businesses depends on the sector in which they work, the stage of their growth et cetera.

Developed companies having an entrenched business, and consistent cash flows can be valued by conventional methods such as the Discounted Cash Flow (DCF) method, Comparable Transaction Method (CTM), price to earnings ratio of comparables et cetera.

For the young ones, if they have not attained a significant mass or market share in a particular region or niche section, there are distinct strategies that can be used for appraising investments, such as the Scorecard Valuation Method, Berkus Method, Risk Factor Summation Method, Venture Capital method et cetera.

Particular multiples can be used for the assessment of a FinTech having distinctness based on the business segment. For example, a fintech firm that has a loan portfolio that can be assessed using enterprise worth to loan book ratio. A firm working in the payments segment can be assessed using the comparable ratio of business value to the number of existing users or a multiple for transaction value. An asset management this firm can be evaluated using enterprise value to assets under management ratio and so on.

FinTech companies are gaining at the cost of traditional banks

According to reports, the existing FinTech firms in India have earned one-third of new revenue at the detriment of traditional banks.

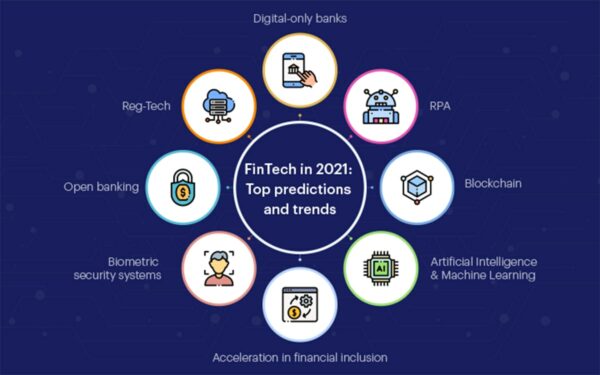

Also, there are various sectors in the Indian FinTech scope, giving clarifications in distinct financial areas such as digital payments, wealth management, insurance, peer-to-peer lending et cetera. Apart from the payments business, to which the FinTech companies owe its beginning, these have tremendous growth opportunities.

Hence, just like conventional start-ups, for professionals operating in the fintech segment, EBITDA or profitability is not always the factor, but being in a sector that has an addressable market.

That’s why a simply low margin payment business may not have notable value and such entities may not get procured by companies wanting to build an ecosystem or a traditional business wanting to add a technological edge. For example, Axis Bank procured Freecharge, Bajaj Finance started Bajaj Pay and, in the means, starting five marketplace products to ultimately become a fintech.

Moreover, we see that the era of being only in the payment business is gone as many FinTechs companies have upgraded themselves from the payment business to building an ecosystem. Paytm is the ideal example.

PhonePe is another example which along with Centrum has been enthusiastic about growing into a technologically enabled banking system by obtaining a small finance bank license. Finally, the vast transferable market can be an opportunity to cross-sell. Further, there is a tremendous possibility once a FinTech company has built a systemic ecosystem.

Estimate based on the sum of parts

Depending on the various sectors of the companies like payments, lending, investments et cetera, the perfect way will be to evaluate these businesses on a SOTP (Sum Of The Parts) method, for businesses having different awards and risks.

A FinTech company could incorporate diverse sub-sectors and all of these may not need a banking license as by the present law.

There are several sections such as Insuretech, Weathtech, and P2P lending among others which do not need a banking license.

This is the main reason for the growth of the majority of FinTech companies in these sectors. A recent example is Cred. The company as a FinTech has a remarkable data bank to utilise the information to cross-sell.

For those who are getting slightly confused over the term ‘cross-sell,’ it is a method of selling additional products to existing customers, and is often practised in the Financial Industry.

Even though FinTechs do not hold a banking license, P2P payment services are offered by them. However, the restricting determinant is that they cannot keep customers’ money as deposits.

On the other hand, banks are constantly losing customers to FinTech companies. Therefore, a collaborative relationship between banks and fintech players is forming into Banking as a Service (BaaS) in which banks can share their infrastructure with these FinTech companies.

We can see that possessing a banking license could benefit FinTechs to have a larger customer base and expand faster due to the technological advantage, rendering an extensive data mine to cross-sell.

Ambitions of Fintech companies in banking

In the last couple of years, various FinTech companies obtained licenses to function as a bank, and eventually, they became a bank.

For example, PhonePe and Centrum’s recently acquired the troubled Punjab and Maharashtra Cooperative (PMC) Bank. Their companies through their innovation, distinguished by coordination and faster judgment making, desire to intrude the traditional model.

For these businesses to go down the traditional banking route though seems absurd, one has to regard that these companies are disruptive because of the technology they offer and that is precisely what the conventional banking system lacks.

Therefore, their businesses are not only producing ecosystems but other FinTech marketplace platforms. For example, the insurance platform Policybazaar has declared to associate with Paytm and Ola. The private sector lender and financial bank, IndusInd Bank and a few consortium actors plan to set up a New Umbrella Entity (NUE) to develop a national payments infrastructure company.

As mentioned earlier, many established banks after understanding this fact, have ventured to acquire start-ups, associate with them, or build their own digital offerings.

Examples of these are Citi Bank’s investment in lending firms FastPay, C2FO, BlueVine. Also, JP Morgan’s investment in Prosper, LevelUp or GoPago.

Now, those companies are aspiring to be more like banks. From a payments business to a lending marketplace, we can see all sorts of FinTechs across regions moving towards acquiring a banking license.

Edited by Aishwarya Ingle