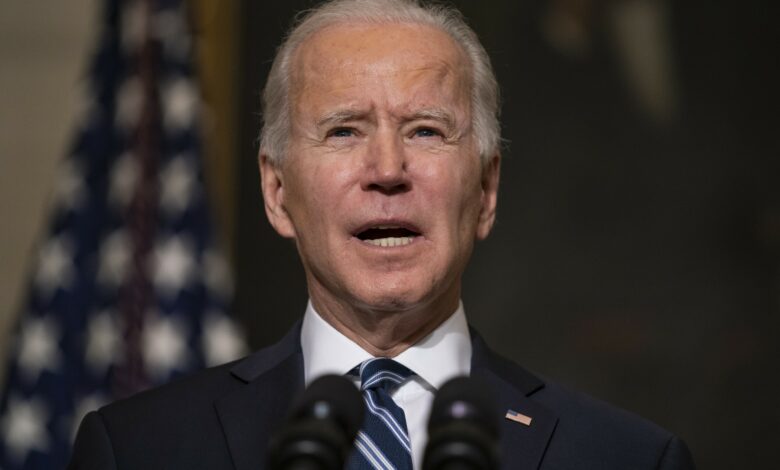

Biden directs US to mitigate financial risk from climate

President Joe Biden is directing federal agencies to develop a comprehensive strategy to identify and manage financial risks to government and the private sector posed by climate change.

An executive order Biden issued Thursday calls for concrete steps to mitigate climate risks, while protecting workers’ life savings, spurring job creation and helping the United States lower greenhouse gas emissions that contribute to climate change.

New regulations could be issued on the banking, housing and agriculture sectors, among others.

Extreme weather related to climate change can disrupt entire supply chains and deprive communities of food, water or emergency supplies,? the White House said in a statement Thursday.

Snowstorms can knock power grids offline, while floods made worse by rising sea levels can destroy homes and businesses.

The new strategy is intended to identify public and private financing needed to mitigate such risks and help safeguard Americans’ financial security, the White House said.

Biden has made slowing climate change a top priority and has set a target to cut US greenhouse gas emissions by up to 52 per cent below 2005 levels by 2030. He also has said he expects to adopt a clean energy standard that would make electricity carbon-free by 2035, along with the wider goal of net-zero carbon emissions economywide by 2050.

The executive order directs White House climate adviser Gina McCarthy and economic adviser Brian Deese to develop a government-wide strategy within four months to identify and disclose climate-related financial risks.

Treasury Secretary Janet Yellen and the White House Office of Management and Budget also would be involved, while the Labour Department will analyze how to protect pensions from climate-related risk.

Yellen also will be directed to share climate-related financial risk data and issue a separate report within six months.

The Securities and Exchange Commission has already begun work on potential regulations that would require companies to disclose risks related to global warming, while Federal Reserve Chairman Jerome Powell said his agency has begun taking steps to assess climate change-related risks to the banking system.

Whether through rising seas or extreme weather, climate change “already presents increasing risks to infrastructure, investments and businesses. Yet, these risks are often hidden,” the White House said.

“From signing a loan for a new home or small business to managing life savings or a retirement fund, it is important for the American people to have access to the information needed to understand the potential risks associated with these significant financial decisions,” the administration explained.

The new executive order “ensures that the right rules are in place to properly analyze and mitigate these risks’ and disclose them to the public, empowering the American people to make informed financial decisions,’ the White House said.

Environmental groups hailed the executive order, saying Biden recognizes the enormous risks posed by climate change.

“The Biden administration affirmed today it recognizes that corporate disclosure and voluntary commitments alone are not sufficient for addressing systemic climate risks and that regulators must act,’ said Ben Cushing, a financial advocacy campaign manager for the Sierra Club.

Twelve Republican senators wrote a letter to Powell earlier this year accusing the central bank of moving beyond the scope of the Federal Reserve’s mission by increasing scrutiny of climate threats.