Both People and Businesses are dying from the lack of oxygen supply

Hundreds of small to mid-sized companies could be affected by the decision to divert oxygen supplies from industry to hospitals around the country, according to company executives. Thousands of tonnes of medical-grade oxygen are being pumped by more than a half-dozen companies, including Tata Steel Ltd, Reliance Industries Ltd, JSW Steel Ltd, and SAIL Ltd, as India battles the worst outbreak of coronavirus infections in history. The disruption in supply for industrial use, however, could hurt small and mid-sized businesses in metal fabrication, automotive parts, shipbreaking, paper, and engineering, according to analysts.

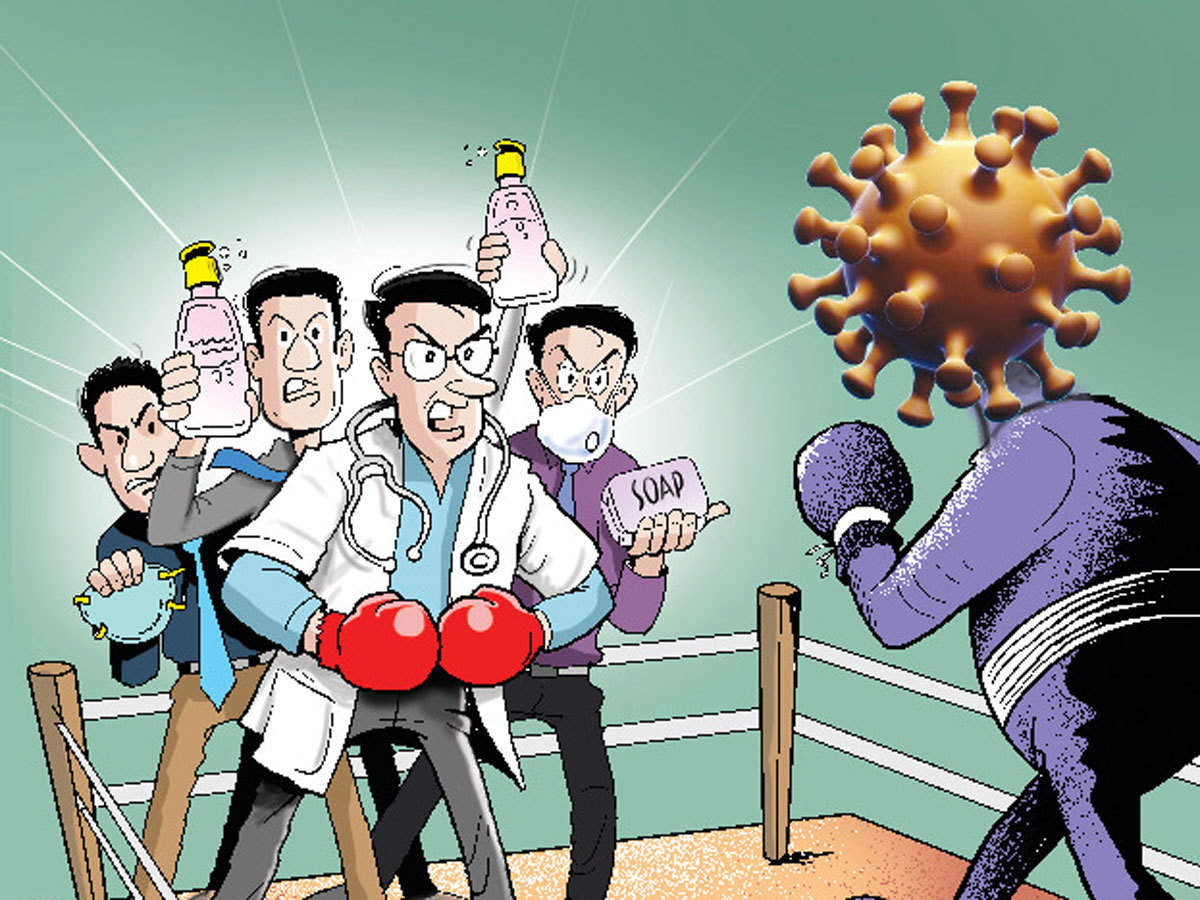

How is India battling the crisis of rising demand and stagnant supply of oxygen?

In the second week of April, the need for medical oxygen more than fivefold. Liquid medical oxygen, or LMO, is a critical medical prerequisite for the care of covid patients. On April 18, the government imposed restrictions on the availability of oxygen for industrial use. However, several industries were removed including manufacturers of ampules, vials, and oxygen tubes, pharmaceuticals, petroleum refineries, steel plants, nuclear energy facilities, wastewater treatment plants, food, and water purification, and process industries that need furnaces to operate continuously. Through merchant suppliers, these small and medium-sized companies usually have no captive Oxygen Plants and supply their requirements for operations, such as welding, cutting, cleaning, and chemical processes, says Gautam Shahi, Crisil Ratings’ director.

It is time-consuming and expensive to install an air-separation plant or procure oxygen, which for these enterprises is unviable and makes it vulnerable. Reliance Industries said on Tuesday that it is tweaking manufacturing at its Jamnagar oil refineries to manufacture over 700 tonnes of medical-grade oxygen per day, up from its previous commitment of 100 tonnes per day. On Tuesday the Tata Group said that 24 cryogenic containers will be imported to transport liquid oxygen. Indian Oil, Ltd (150 tonnes), the state-owned Indian Oil Corp., and Bharat Petroleum Corp. Ltd (100 tons a day), too, have begun to discharge oxygen from refining. Every day, the JSW Group provides 610 tonnes of medical oxygen.

Why do industries need oxygen?

Industry consumes oxygen in two ways: onsite and by merchant transactions. Captive plants for process-driven industries, which account for 75-80 per cent of oxygen manufactured in India, are used on-site. The remainder is obtained by merchant purchases of liquid oxygen, which is stored in cryogenic tanks and cylinders. The healthcare industry accounts for 10% of all retail revenue. This interruption of industrial oxygen supply will last for another six to seven weeks, posing a risk to manufacturing operations. It will not, however, be as serious as last April, according to Madan Sabnavis, Care Ratings’ chief economist. Dasharath Panchal, the owner of Swastik Industrial Fabricators in Andheri, Mumbai, said he has stopped taking new orders because he needs oxygen for thermal cutting. Orders for other natural gases, such as helium, are being accepted for operation, according to Panchal.

Who will bear the brunt of the second wave of coronavirus infections?

Automobiles, retail, and small businesses can bear the brunt of the second covid wave. Analysts predict a downturn in the industry and a fall in wages and investment as states impose lockdown-like restrictions to stave off the second wave of the coronavirus pandemic, with consumer-facing industries and small and medium-sized enterprises (SMEs) bearing the brunt of the effect. Analysts expect hotels, aviation, consumer shopping, tour and travel, multiplexes, cars, financials, and select consumer discretionary industries to be the hardest hit. In terms of consumer response, according to Amit Shah, head of India equity research at BNP Paribas, the effect will be close to that of 2020, but the magnitude will be significantly less extreme. The lockdown is less harsh than we have seen last year, and we are much more economically prepared to deal with the spread of covid. So, select demand pockets, such as customer banking, tourism, and other services, will be immediately affected by a demand perspective, said Shah. He estimates that demand is going to again take a back seat, particularly for discretionary goods. High beta markets, such as automobiles, finance, and selected consumer discretionary sectors, would be affected by a specific industry. In consequence, sectors such as IT and pharmaceutical, considered protective purchases, as well as consumptive products, would be returned to the market, at least in the short term.

The first order would have the same effect on the economic sectors as in the first round but will have a much larger effect on the second order. Recovery will undoubtedly be delayed for these industries, a report by Nomura said. Since customers would this year be reluctant to replace their units and kitchenware for one year, several areas that benefitted from the pent-up demand in 2020 will not be supported by the same demand. According to the study, the latest market correction has resulted in just a minor fallout from the second wave. Indian markets have now lost approximately 8 per cent of their value after reaching new highs following the Union Budget in February of this year. Both benchmark indices have declined around 4 per cent this month, compared to a 20 per cent drop in March 2020 in response to the nationwide lockout. Poor economic sentiment, according to Nomura, is reflected in slower loan expansion, which is expected to remain subdued until the effect of COVID-19 is completely mitigated. However, India’s second wave is not an outlier. Sixteen of the top 30 countries by Gross Domestic Product (GDP) have seen a third or fourth wave. We will continue to see those waves, big or small, until enough people grow antibodies, depending on the severity of virus mutations and vaccine efficacy.