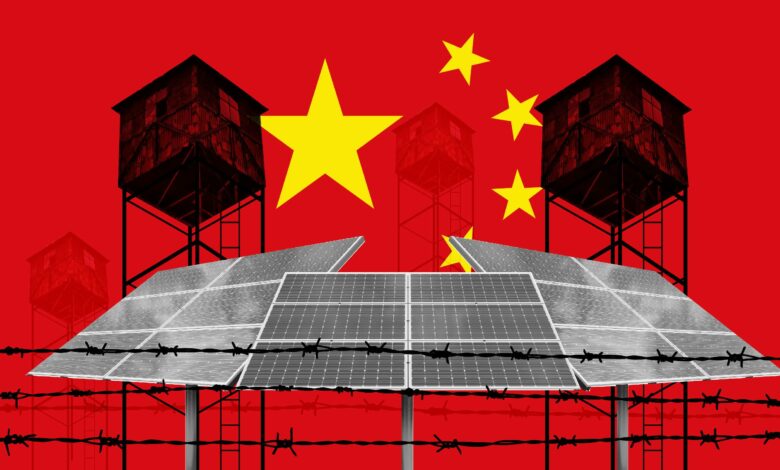

Solar Power is another industry that is dominated by China’s Xinjiang region notorious for genocide claims

Accelerating champions of the global solar power industry face an already underestimated challenge: Xinjiang, China, the area some say is notorious for the genocide of local ethnic minorities including the mostly Muslim Uyghur people.

What challenges does China’s Xinjiang region face?

About half the world’s polysilicon production, which is important in most solar panels, comes from this part of northwestern China, where human rights activists and U.S. officials claim that China maintains a widespread internment camp network that the U.S. claims have held more than a million Uyghurs, a Muslim minority community. Those in the renewable energy sector fear that polysilicon and other products from Xinjiang could be linked with forced labour. And the lack of free travel to Xinjiang means that suppliers are not somehow associated with the misuse of human rights. There is rising global demand to restrict trade with Xinjiang. The U.S. and the European Union weigh laws that could contribute to import bans on other re-regional materials, including polysilicon. In January, the USA already banned imports of cotton and tomatoes provided by Xinjiang.

Many Western solar firms are seeking to reduce exposure in the region and are concerned about their industries. Zaid Ashai, CEO of Boston-based Nexamp, which purchases solar panels and other components from China, said that sending of independent auditors to Xinjiang for operations in China has almost not been feasible. Nexamp aims to go as far as the supply chain can in order to ensure that it meets ethical expectations for labour, Mr. Ashai said. The business now expects to continue to purchase from Chinese manufacturers and hopes that the industry will develop a monitoring mechanism to ensure that nothing is manufactured in Xinjiang.

What is China’s claim on the matter?

While China’s Xinjiang suppliers claim they have no forced labour at this point, attestations without verification do not mean anything, Mr. Ashai said. And we, the world’s people, have to take this seriously, considering the troubling news and human rights stories that are leaking from the province. The Government of China claims that Xinjiang does not have any slave labour in its solar sector and its activities are intended to fight terrorism and create livelihoods. It is their loss, a state spokesman said, if western solar firms cease to do business with China.

Polysilicon is created by an energy-intensive process that involves chemically purifying silicon at incredibly high temperatures. The resulting material is shaped into crystal ingots, which are then cut into thin wafers and assembled with other electronic components to form solar panels. Daqo New Energy Corp., one of Xinjiang’s four major polysilicon producers, said slave labour is “morally abhorrent” for the firm, which has a “zero-tolerance policy.” The organization said that it knows of no slave labour being used in the Xinjiang solar supply chain. The three other firms, GCL-Poly Energy Holdings Ltd., Xinte Energy Co. and the East Hope Group, failed to respond to comments.

How is this affecting the global solar power industry?

Xinjiang will be difficult to exclude from the solar industry, because of the structural nature of the supply chain and the locking of Chinese demand, many insiders and experts in the industry claim. Xinjiang polysilicon cannot be avoided, said Dennis, an analyst at the Hong Kong Daiwa Capital Markets. If the United States takes sanctions seriously, it’s nothing positive for the growth of the solar industry on a global level.

The U.S. National Commercial Organization, the Solar Energy Industries Association, urged representatives to shift the supply chain from Xinjiang by June, to establish monitoring systems so that their goods are not contaminated. Some investors have begun advising customers that US sanctions will be imposed. European lawmakers have stated that they are willing to take this step, even though it means delaying the shift to renewable energy, which is one of the bloc’s main policy goals.

How dominant is China’s position in this industry?

China is the leader in magnets. Businesses and policymakers in the Western world are preparing to fight China’s supremacy in a core feature of industrial technology: the magnet. Analysts and executives predict that the scores of firms competing for government funding will fail to construct a supply chain that can compete with China’s rare-earth magnet sector, which has a decades-long head start and staunch government support. Rare-earth magnets are used in electric vehicle motors, wind turbines, and other technologies. According to researchers, China mines over 70% of the world’s rare earth magnets and controls 90% of the complex method of converting them into magnets. Beijing wields power over manufacturers of a wide range of rapidly evolving technologies as a result of this domination.

The US government is spending tens of millions of dollars on rare earth mining and processing. President Joe Biden signed an executive order in February ordering a study of essential materials supply chains, including rare earths. In addition, his new infrastructure proposal included funding for rare-earth separation programs. European, Canadian, Japanese, and Australian officials are now taking their chequebooks out. Yet, according to economists, Western industries are either year away from adding to a reliable supply of rare earths, or from refining them into different minerals and converting them into valuable items such as magnets.

You’ll need a lot of experience and knowledge to get these minerals from a pit in the ground to an electric motor, which barely exist out of China, said Constantine Karayannopoulos, chief executive of Neo Performance Materials ULC, one of a few Western companies able to process rare earths and make magnets. Without any sort of continuing government support, many producers would find it difficult to compete on price with China, he claimed. Without any sort of continuing government support, many farmers would find it difficult to compete on price with China, he said.

Rare Element Resources Ltd., along with its partner, defence contractor General Atomics, recently received a $22 million Energy Department grant to process rare earth. Eight years after application, the mining company was not permitted to exploit the deposit in Wyoming. It paused its application in 2016 due to a lack of funding. Having a mine up and running, is not easy, according to Chief Executive Randy Scott. The company said the intention is to process material gathered when checking the consistency of its site since its mine has yet to be established. This stock is likely to produce hardly 100 tons of rare earth, Scott said. The weight necessary for magnets to be used to produce 6,000 Toyota Prius vehicles is equivalent to this. Almost 2 million hybrid and battery cars were delivered in 2019 in Toyota.

If Rare Element Resources gets a mining permit, they are 6 – 9 years away from a daily supply of refined rare piles of earth, says Mr Scott, considering the time they need to enable and develop the mine. The Chief Executive Officer of Rare Earth USA, Pini Althaus, plans to build an American supply chain for the mines-to-magnet industry and hopes this year to make it official. Some consultants doubt the accuracy of USA Rare Earth’s deposit in Texas after an earth mineral fraction of 0.06 per cent, discovered as a session in 2019. This contrasts 3% to the Rare Element Resources site of the competitor and 7.06% to the MP Materials Corp, the sole producer for the United States. Mr. Althaus claims minerals at his place are one of the 17 rare piles of earth most precious. Following Hitachi Ltd.’s decision to close a magnet factory in 2015, USA Rare Earth purchased magnet manufacturing equipment from a Japanese company. The package is reportedly stored in a North Carolina warehouse.